Trusts are generally created when one person or firm manages assets for the benefit of…

Medicaid and the Stimulus Checks

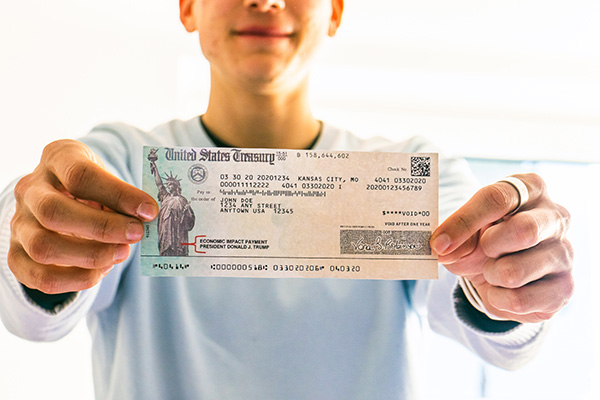

As part of the coronavirus recovery effort, most Americans are getting direct payments from the federal government known as “stimulus checks.” This money is paid to ease the pain of the Covid pandemic and to jump-start the economy.

The stimulus money should have arrived in the same way that Social Security payments or tax refunds are made, either direct-deposited into a bank account or mailed as a paper check. If the money has not arrived, or for guidance in general, consult the IRS website:

https://www.irs.gov/coronavirus/economic-impact-payment-information-center#more. Other options are to call 800-919-9835 or 800-829-1040, or you can visit your local Taxpayer Assistance Center.

Those who are receiving means-tied government assistance, like SSI, VA benefits, or Medicaid to pay for long-term care, need not worry that stimulus money will be counted against them for eligibility. As long as recipients spend the money within twelve months, the money will not push them over the maximum amount they are permitted before they are penalized.

Recipients may use the money to buy new clothing, cell phones or televisions, toiletries, snacks, dental treatment, or improved quality of medical supplies. They may buy an irrevocable funeral trust, to avoid future expense to family members. They may give the money away to family or charities. The money might pay for updating estate-planning documents, or for consulting a geriatric care manager. (Some commentators believe that you could give the money away to family or charities. While this may be OK under federal law, it’s probably best not to take chances with how the states may interpret it. Spend the money, don’t donate it.)

Provided that the money is not spent on what could be called an asset or an investment – like, for example, rare coins or stocks or bonds – the money will not be counted against the asset limit for Medicaid eligibility. And, again, the money must be spent within twelve months. It must not be forgotten-about or left unnoticed in a bank account.

It also must not be misappropriated by nursing homes or assisted-living facilities. If this has happened to you or your loved one, inform the facility manager that the money must be refunded to the resident. Cite the law that carves out the payment from being counted toward federally assisted programs like Medicaid: 26 U.S.C. § 6409. Or, show them a handout downloadable from the Congressional Research Service.

If the facility will not refund the money, contact your state’s attorney general. Then lodge a complaint with the Federal Trade Commission.

Recipients of assistance, like anyone else, are free to spend their stimulus money. The money is theirs. It is tax-free. It is intended to be spent, and it should be spent, in any way the recipient would like (subject to the conditions above).

This is one time when spending is unquestionably a good thing – for buyers and sellers.

If you have questions or would like to discuss your situation in a confidential setting, please don’t hesitate to reach out.

We hope you found this article helpful. Please contact our Albany office today at (518) 452-6979 and schedule a free consultation to discuss your legal matters.